5 Easy Facts About P3 Accounting Llc Described

Wiki Article

P3 Accounting Llc Fundamentals Explained

Table of ContentsThe Best Strategy To Use For P3 Accounting Llc4 Easy Facts About P3 Accounting Llc DescribedP3 Accounting Llc Things To Know Before You BuyP3 Accounting Llc Can Be Fun For EveryoneLittle Known Questions About P3 Accounting Llc.Excitement About P3 Accounting Llc

Or, as Merhib put it, "You require to have the publications in great order to recommend your clients on what they can be making with their businesses." The majority of companies that use CAS offer either one or a handful of particular niches and for excellent factor. "Clients want professionals, not generalists," Mc, Curley claimed.

Yet obtaining this understanding requires time, effort, and experience. To be an effective advisor, a CPA may require to end up being thoroughly acquainted with an offered industry's procedures, risk variables, customer types, KPIs, regulative setting, and so on. CPAs that collaborate with doctors, for instance, need to understand about invoicing and Medicare, while those that work with dining establishments need to find out about food patterns, distribution expenses, and state regulations regarding tipping.

See This Report about P3 Accounting Llc

Having a particular niche can additionally help companies focus their advertising and marketing initiatives and choose the best software. It can additionally assist a firm streamline its processes, something ACT Solutions understood when it selected to specialize. The company began as generalists, recalled Tina Moe, CPA, CGMA, the owner and CEO of ACT Solutions."I joked that our customers simply had to be nice, be certified, and pay our expense." Currently that they focus on 3 industries, Fuqua claimed, "we're able to standardize and automate and do things a lot more quickly." Due to the fact that starting a CAS practice is such an intricate undertaking, companies require to fully dedicate to it for it to thrive (see the sidebar "Making Pizza Earnings").

That implies devoting cash, team, and hours to the CAS undertaking. Ideally, have somebody devoted to CAS full-time, Merhib said. OKC tax credits. You may begin off having a staff member from a different location functioning component time on your CAS campaign, that's not lasting in the lengthy run, he claimed.

Our P3 Accounting Llc Ideas

Otherwise, he said, they'll have a hard time to succeed at balancing both aspects of the role. Many sources currently exist to aid companies that are starting to provide CAS. Organizations including the AICPA have developed products firms can use to learn concerning CAS and use training programs that cover every Recommended Site little thing from pricing to staffing to how to speak to customers about the value of CAS.After her company took some actions towards CAS on its very own, she took a CAS workshop she found extremely helpful. "We were trying to take bits and items of information from different sources to try and create our own CAS division, but it was like reinventing the wheel. It was really taxing," she stated.

Little Known Facts About P3 Accounting Llc.

For instance, Hermanek and his group had the ability to considerably improve a client's cash flow by obtaining them to embrace computerized accounts receivable software application. By doing so, the customer's accounts receivable gone down from an average of 50 days down to thirty days. Make certain to provide your CAS staff sufficient time to train on technology, Hermanek said.

You possibly didn't begin your company to procedure financial declarations, spend hours looking into tax conformity laws or stress about every information of the deductions on your employees' payroll. The "company" side of company can sometimes drain you of the power you intend to route towards your core product and services.

P3 Accounting Llc Things To Know Before You Buy

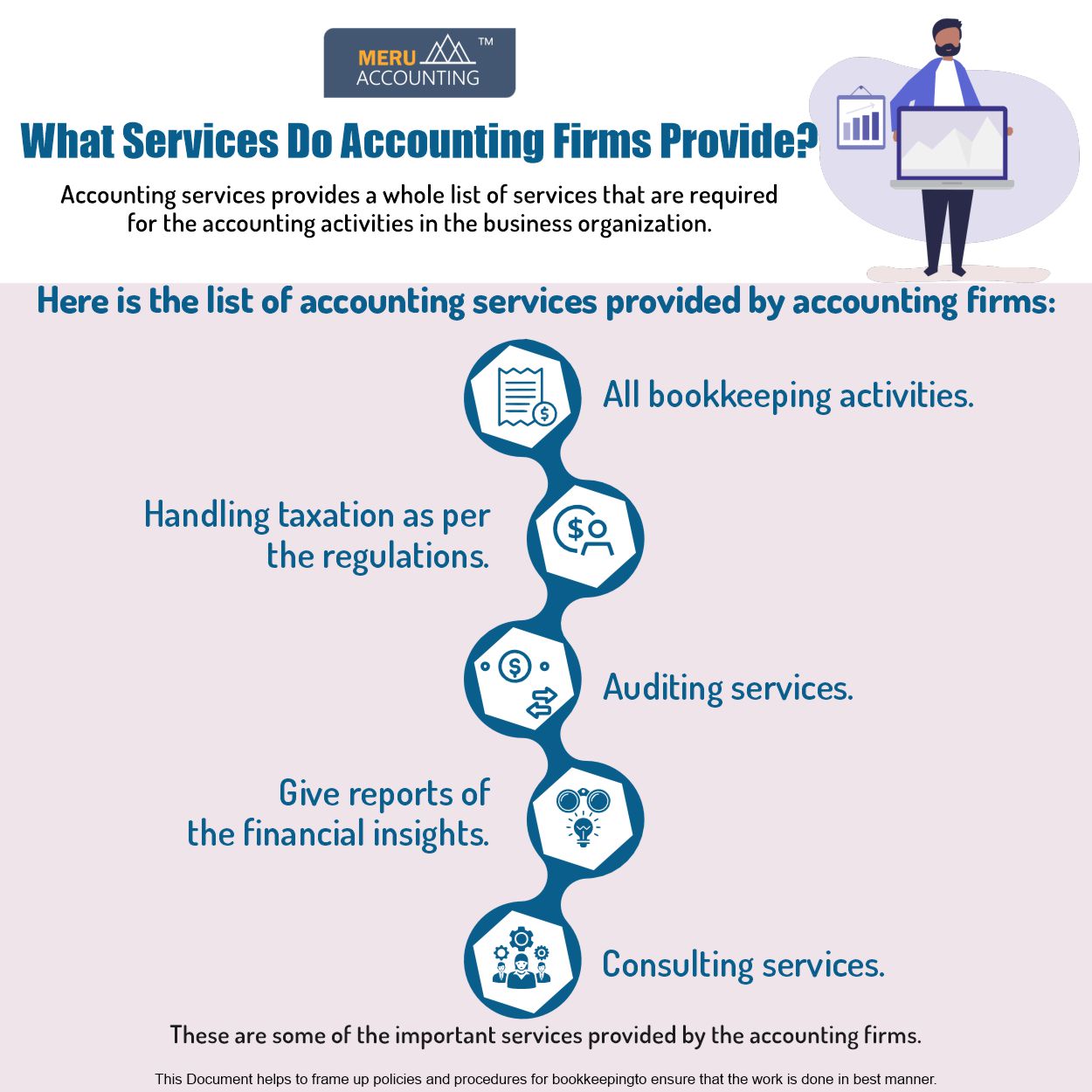

The solutions you can acquire from a specialist accounting firm can be personalized to satisfy your demands and can include standard everyday accounting, tax obligation solutions, bookkeeping, monitoring consulting, fraudulence examinations and can also work as an outsourced principal financial officer to offer monetary oversight for your little service. From the Big Four (Deloitte, Pricewaterhouse, Coopers, KPMG and Ernst & Young) down to small-business accounting firms, the major solutions used consist of accountancy and bookkeeping.The firm can help you with long-range planning, such as buying residential or commercial property or upgrading your facilities. It can additionally help you identify exactly how to recover cost and what your cash-flow needs are. These solutions help you plan your following actions, determine whether you are earning a profit and choose concerning your business's growth.

This may be a need of your financiers or written right into the laws of your consolidation. https://anotepad.com/note/read/m5yjti3b. Accounting firms carry out audits by checking out not only financial records, yet also the processes and controls in position to ensure documents are being effectively maintained, plans are being followed, and your economic practices help support your business objectives and are one of the most reliable method to do so

The 45-Second Trick For P3 Accounting Llc

A prominent specialty location, lots of accountancy firms provide a variety of tax obligation solutions. The firm's accountants can aid you figure out a new tax obligation code to help guarantee your financial coverage practices remain in compliance with existing IRS laws, identify your firm's tax responsibility, and make certain you meet declaring demands and due dates.Report this wiki page